The Internal Revenue Service has updated its tax brackets for 2019.

2019 will mark the first year under the Trump-backed tax reform bill, which overhauled the tax code that resulted in lower individual income tax rates, a doubled standard deduction and elimination of person exemptions.

Recommended Videos

Related: Say goodbye to these 3 tax deductions on your 2018 filing

The standard deduction has also increased for 2019, rising to $12,200 for single filers (up from $12,000 in 2018). Married joint filers will be eligible for a $24,400 standard deduction, an increase from $24,000 in 2018.

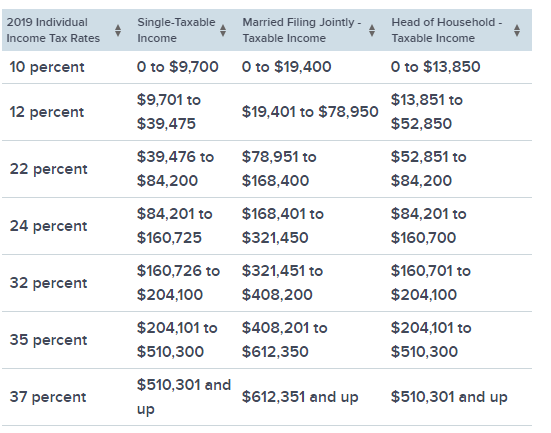

Your 2019 individual income tax brackets:

Source: IRS, CNBC

More insight from CNBC:

The IRS boosted the employee contribution limit for 401(k), 403(b) and most 457 plans to $19,000, reflecting an increase from $18,500. Savers age 50 and older can put away an additional $6,000.

If you have an IRA, you can put away $6,000 in annual contributions in 2019. That's up from $5,500. Catch-up contributions for savers age 50 and older remain at $1,000.

Filers should take note that in 2019, the IRS will do away with the individual mandate — the fine that people pay for failing to maintain qualifying health insurance coverage.

On a per-person basis, this penalty added up to $695 per adult and $347 per child under age 18.

Be aware that if you went without coverage in 2018, you'll likely be subject to the fine when you file your taxes in April 2019.

There are a series of information forms you'll need to complete your 2018 return and report your coverage status to the IRS: They are Form 1095-A (for coverage purchased in the marketplace), Form 1095-B (sent from insurers to covered individuals) and Form 1095-C (for health insurance offered at work).